Signs That Your Need a Tax Pro Usually, the biggest sign that it’s time to hire a tax pro is that sinking feeling in your gut. You know that you’re not on top of the tax codes. Maybe you’re not even sure when or what to file, or you’ve got that nagging feeling that you’re… Continue reading Small Business Tax Preparation: Work with a Tax Pro

Author: admin

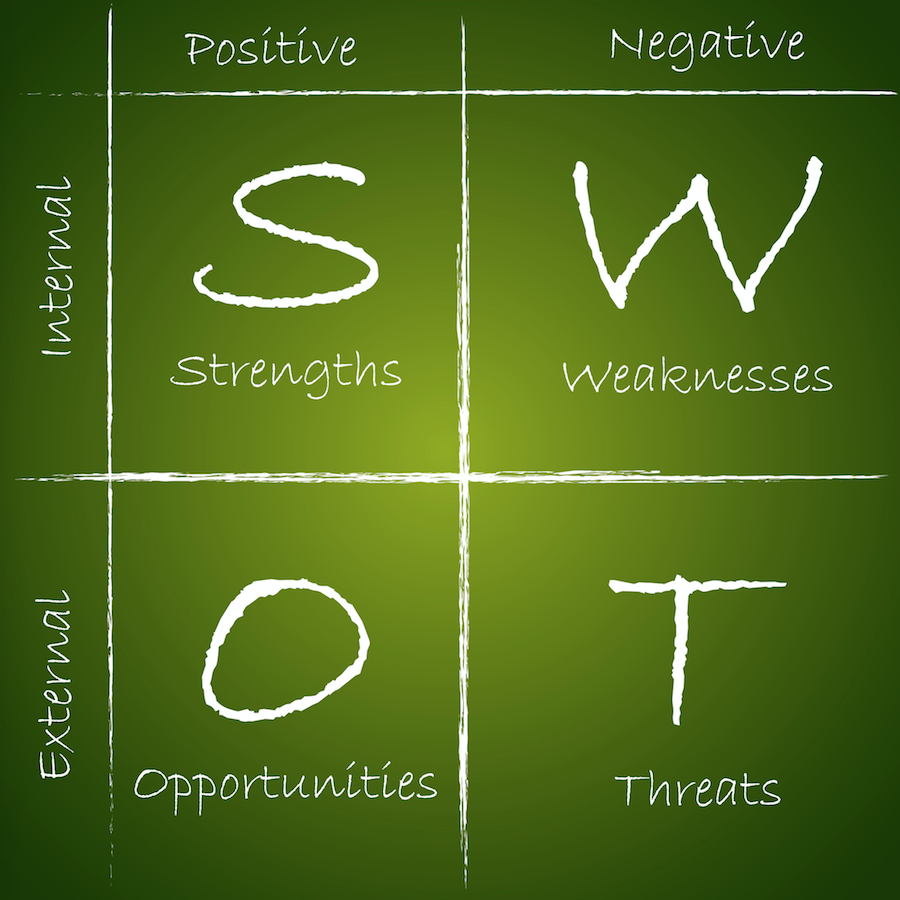

Your Key to Strategic Success: The SWOT Analysis

What is this, Business 101 again? Yes, mention of a SWOT Analysis feels like you’re back in business school or working on your first business plan. I bet, though, that you also remember the SWOT Analysis as one of the fun parts of a business plan. It provides such a great, 10,000-foot perspective on the… Continue reading Your Key to Strategic Success: The SWOT Analysis

1099 Reasons to Hire Independent Contractors

Maybe not 1099 reasons. But there are good reasons to go the independent contractor route versus hiring employees. Of course, there are also compelling reasons to go the other direction on that. There’s a lot to consider when you make this choice, so let’s dive in. Independent Contractors versus W2 Employees Before we get into… Continue reading 1099 Reasons to Hire Independent Contractors

I’m Hired! Going Entrepreneur

Gone to launch! You’ve been thinking of leaving that job and starting your own business for a while now. Or maybe that decision was made for you. In either case, the idea of starting your own business is enticing, the good old American Dream! The question is, are you ready? What’s next? Let’s review that.… Continue reading I’m Hired! Going Entrepreneur

Yay, Taxes! When To File Business Taxes in 2019

The 2019 Federal Tax Calendar for Business Owners There’s good news in 2019! Yes, you still have to pay your taxes, and paying them on time is a great idea. So, what’s the good news? Paying taxes means your business is making a profit! But there’s a catch. There is a new tax law for… Continue reading Yay, Taxes! When To File Business Taxes in 2019

5 Tips in Preparing For Your 2018 Business Taxes

As if taxes aren’t scary and complicated enough, we now have a brand new tax law to learn. As 2018 comes to a close, there are things you can do to plan for your 2018 taxes and potentially save your business tons of cash and yourself some headaches. Here are 5 tips in preparing for… Continue reading 5 Tips in Preparing For Your 2018 Business Taxes

5 Ways to Finish 2018 with a Bang!

2018 is fast coming to a close, and the Holiday festivities are already starting to fill up your calendar. You set some aggressive goals for the year and did some much needed strategic and tax planning with your advisors. Crunch time is coming, and there are some things you can do to finish 2018 strong… Continue reading 5 Ways to Finish 2018 with a Bang!

Assessing the S corp

The S corporation business structure offers many advantages, including limited liability for owners and no double taxation (at least at the federal level). But not all businesses are eligible – and, with the new 21% flat income tax rate that now applies to C corporations, S corps may not be quite as attractive as they… Continue reading Assessing the S corp

Choosing the right accounting method for tax purposes

The Tax Cuts and Jobs Act (TCJA — check out our download on this) liberalized the eligibility rules for using the cash method of accounting, making this method — which is simpler than the accrual method — available to more businesses. Now the IRS has provided procedures a small business taxpayer can use to obtain… Continue reading Choosing the right accounting method for tax purposes

Contemplating compensation increases and pay for performance

As a business grows, one of many challenges it faces is identifying a competitive yet manageable compensation structure. After all, offer too little and you likely won’t have much success in hiring. Offer too much and you may compromise cash flow and profitability. But the challenge doesn’t end there. Once you have a feasible compensation… Continue reading Contemplating compensation increases and pay for performance